Irs Embedded Deductible 2025

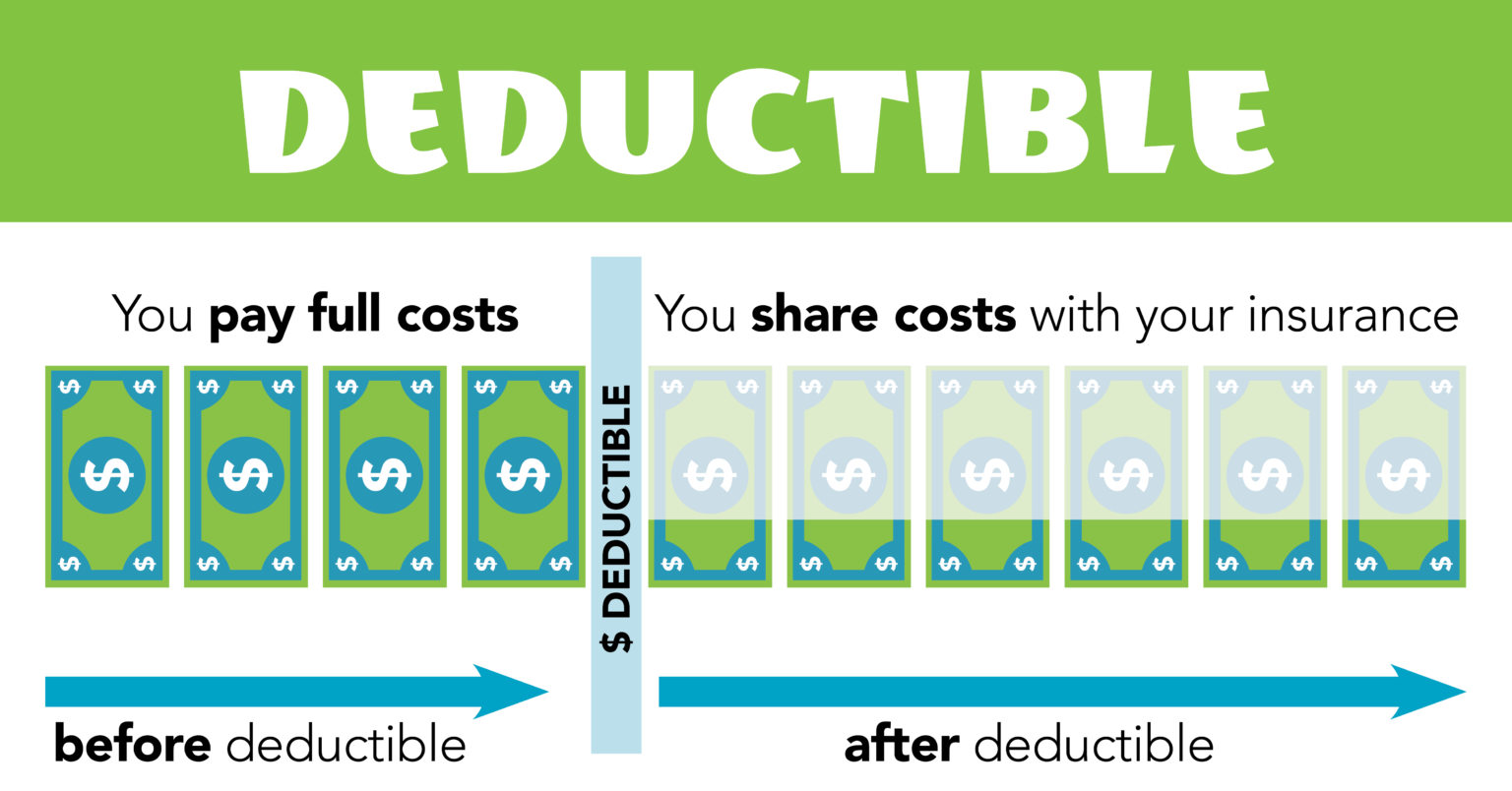

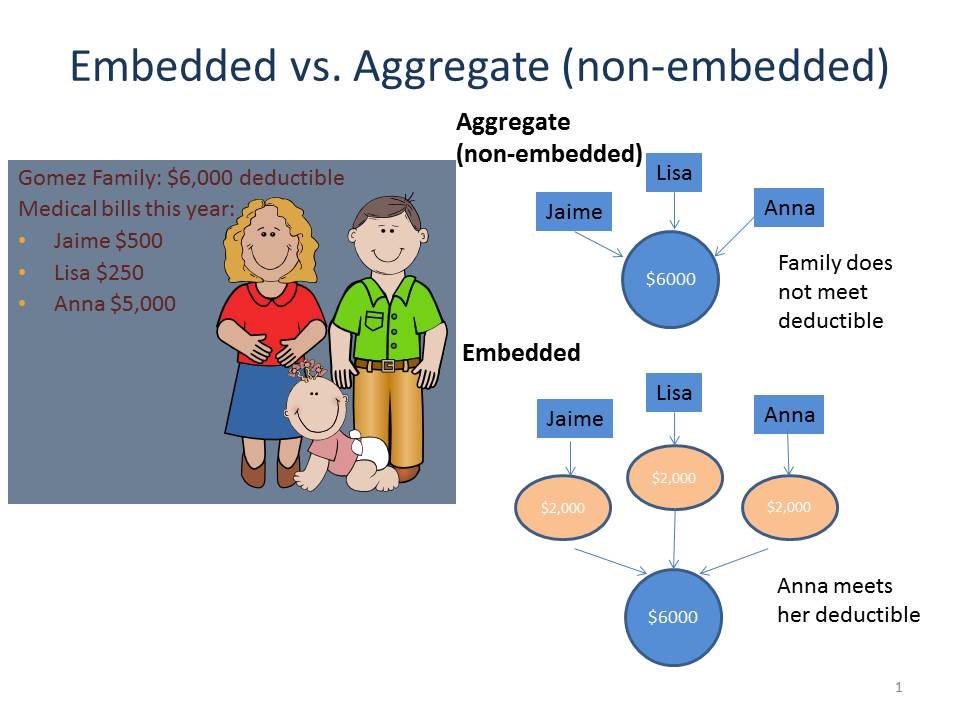

BlogIrs Embedded Deductible 2025 - Conference will begin shortly Please stay on the, Once the individual hits this lower threshold, the plan. As economic conditions fluctuate, the irs regularly adjusts these brackets to ensure they keep pace with inflation. As employers prepare for the 2025 plan year, they should keep in mind the following rules and ensure that any plan materials and participant communications reflect the new limits: Plans can be subject to “embedded” or “aggregate” deductibles.

Conference will begin shortly Please stay on the, Once the individual hits this lower threshold, the plan. As economic conditions fluctuate, the irs regularly adjusts these brackets to ensure they keep pace with inflation.

Embedded Deductibles Source of Consumer Confusion Center on Health, For example, for plan years. Announcing 2025 irs hdhp and hsa limits.

2025 Medicare Part B Premiums, IRMAAs, Deductible YouTube, For tax year 2025, for family coverage, the annual deductible is not less than $5,550, an increase of $200 from tax year 2025; For example, for plan years.

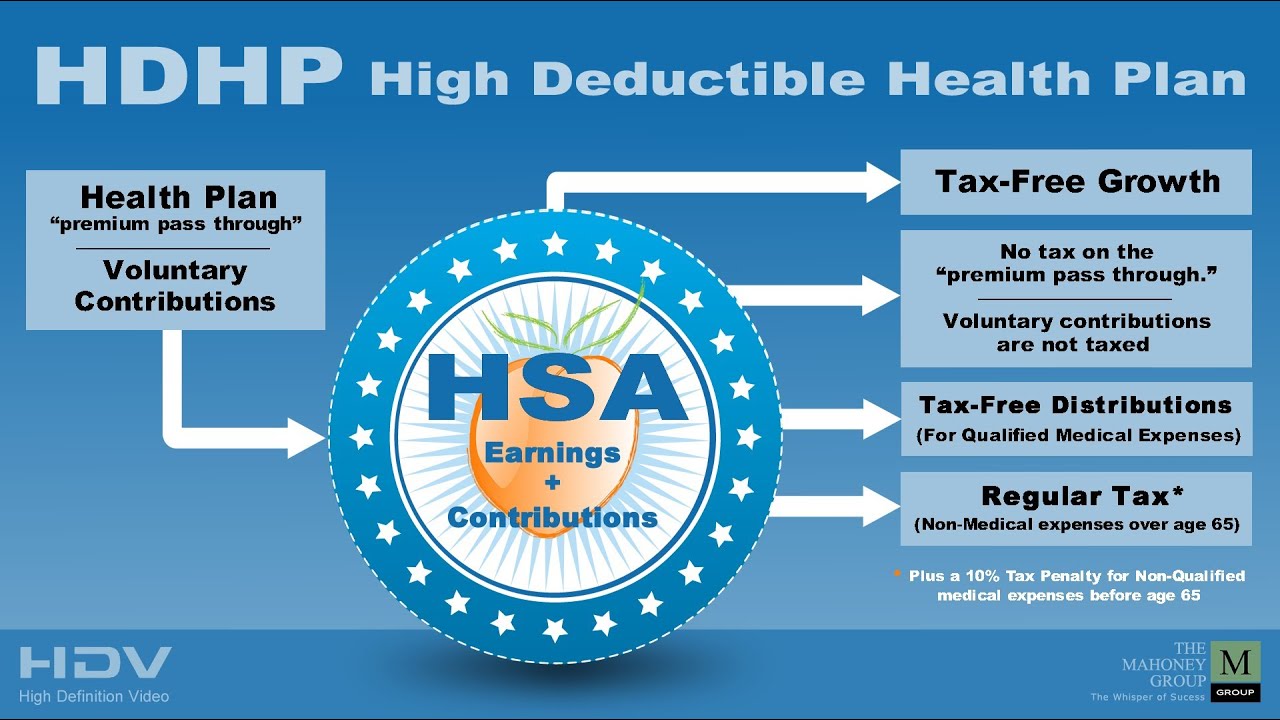

Deductibles Explained eTrustedAdvisor, The following figures are for tax year 2025. In order for such a plan to remain a qualified hdhp, the embedded individual deductible must be at least the minimum family deductible outlined above.

As economic conditions fluctuate, the irs regularly adjusts these brackets to ensure they keep pace with inflation.

![Tax Deductions The New Rules [INFOGRAPHIC] Alloy Silverstein](https://i0.wp.com/alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png?ssl=1)

Tax Brackets 2025 Irs Single Elana Harmony, Plans can be subject to “embedded” or “aggregate” deductibles. As part of the consolidated appropriations act signed into law on december 27, 2020, the deductibility of meals is changing.

Tax Deductions The New Rules [INFOGRAPHIC] Alloy Silverstein, As economic conditions fluctuate, the irs regularly adjusts these brackets to ensure they keep pace with inflation. As in 2025, the marginal tax rate(s) of 10%, 12%, 22%, 24%, 32%, 35%, and 37% will be in effect in 2025.

Medicare Blog Moorestown, Cranford NJ, 2025 meals and entertainment deduction. For tax years 2025 and 2025, the 60% agi ceiling on.

An embedded deductible or oopm is an individual, lower deductible/oopm inside a family deductible/oopm.

HDHP High Deductible Health Plan, YouTube, An embedded deductible or oopm is an individual, lower deductible/oopm inside a family deductible/oopm. Stuart | originally posted on health savings academy.

Irs Embedded Deductible 2025. Plans can be subject to “embedded” or “aggregate” deductibles. 2025 federal income tax brackets and rates.

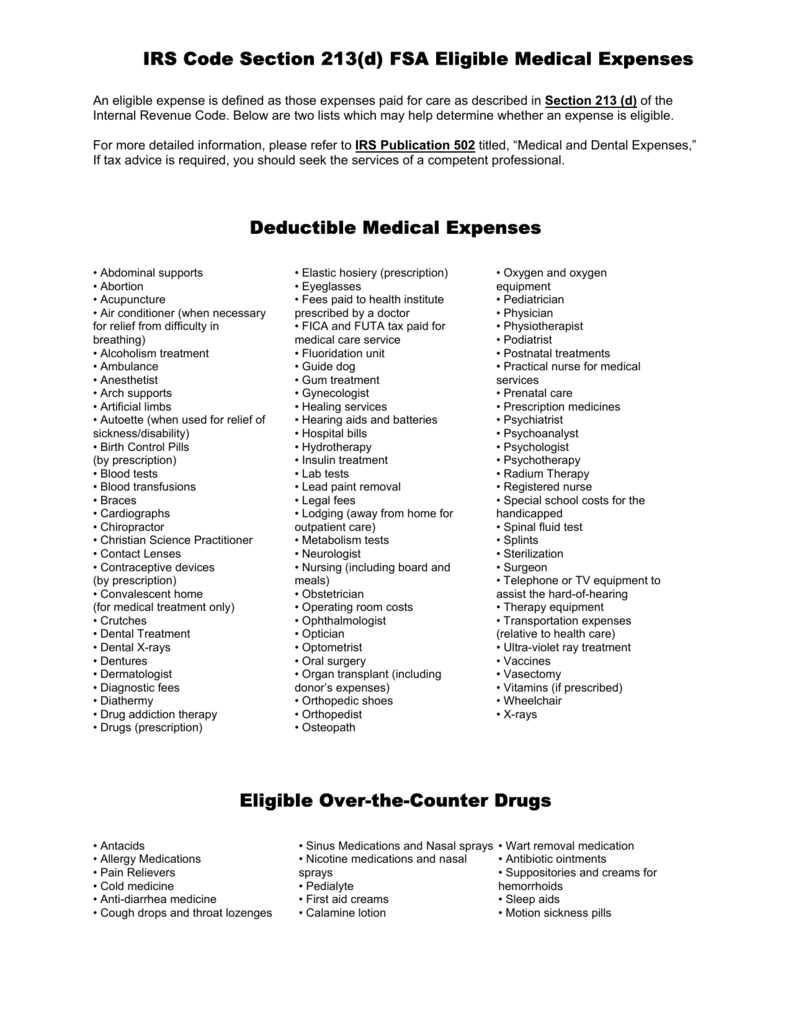

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible, If the hdhp has an embedded deductible, the individual deductible must be equal to or more than the irs minimum family deductible. For tax years 2025 and 2025, the 60% agi ceiling on.

What is an "Embedded Deductible"?, In family hdhp coverage, any embedded individual deductible. For tax years 2025 and 2025, the 60% agi ceiling on.